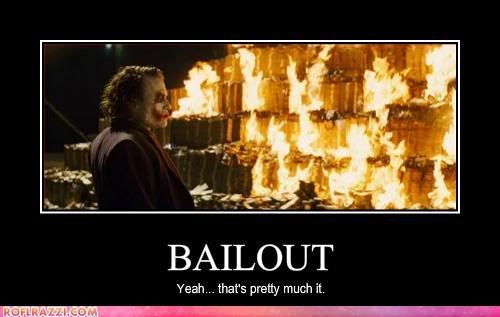

As I have written about the 2008-09 financial crisis (here and here), bailouts appeared to be the only solution at the time. Serious people opposed to bailouts in general, because of their potential to create a moral hazard where there is no dis-incentive to engaging in risky behavior.

As I have written about the 2008-09 financial crisis (here and here), bailouts appeared to be the only solution at the time. Serious people opposed to bailouts in general, because of their potential to create a moral hazard where there is no dis-incentive to engaging in risky behavior.Niall Ferguson of Harvard and Laurence Kotlikoff of Boston University write in the December 03 edition of The Financial Times that the solution is reinstating the Glass-Steagall Act and Limited Purpose Banking (LPB). LPB, as stated in the article:

It transforms all financial companies with limited liability, including insurance corporations, into pass-through mutual fund companies. Limited purpose banks would process securities and sell them to mutual funds. They would not be permitted to borrow to invest. Hence, they would never face a run and never fail. Risk-taking would be done by us, the people, via our purchase of more or less risky mutual funds.

They further state this would be done under the watchful eye of a single regulator. From the article:

Under LPB all mutual fund investments would be fully and instantly disclosed on the web by the system's single regulator - the Federal Financial Authority (FFA). The FFA would verify the credit histories, income statements and third-party custody of all fund securities. It would also hire non-conflicted companies to rate the securities and value their collateral. This does not preclude private rating, but it provides the public with independent assessment.

Although the FFA would provide for instant disclosure and reduced bureaucracy, the authors don't explain what, if anything, the FFA would replace. If it could replace and reduce existing agencies, fantastic! However, if it is another layer of bureaucracy, it should be reexamined.

While world financial markets and firms have been shaken, most economies are returning to some sense of stability. In the US, unemployment remains at 10%+, but credit is becoming easier. Is now the time to establish a new agency? Is now the time to return to previous regulation? The proposition put forth by Ferguson and Kotlikoff should be discussed. Far better to take their advice than that of the current US Congress!